Introduction to LCFF

California’s Local Control Funding Formula (LCFF), established in 2013, determines the allocation of state funds to public school districts, prioritizing districts with larger populations of English learners, low-income students, and foster youth.

Proposition 98

Approximately 40% of all taxes paid into the State of California’s General Fund are allocated to K-14 education under Proposition 98. Burbank, with its large companies and properties, contributes significantly to this requirement, despite only a fraction of its residents having families with children under 18.

Burbank’s Contribution

A City of Burbank report reveals that only 26.8% of all households in Burbank have children under the age of 18, yet all residents contribute 40% of their state General Fund taxes, such as state sales tax, property tax, and income tax, to education funding.

Funding Sources for K-14 Education

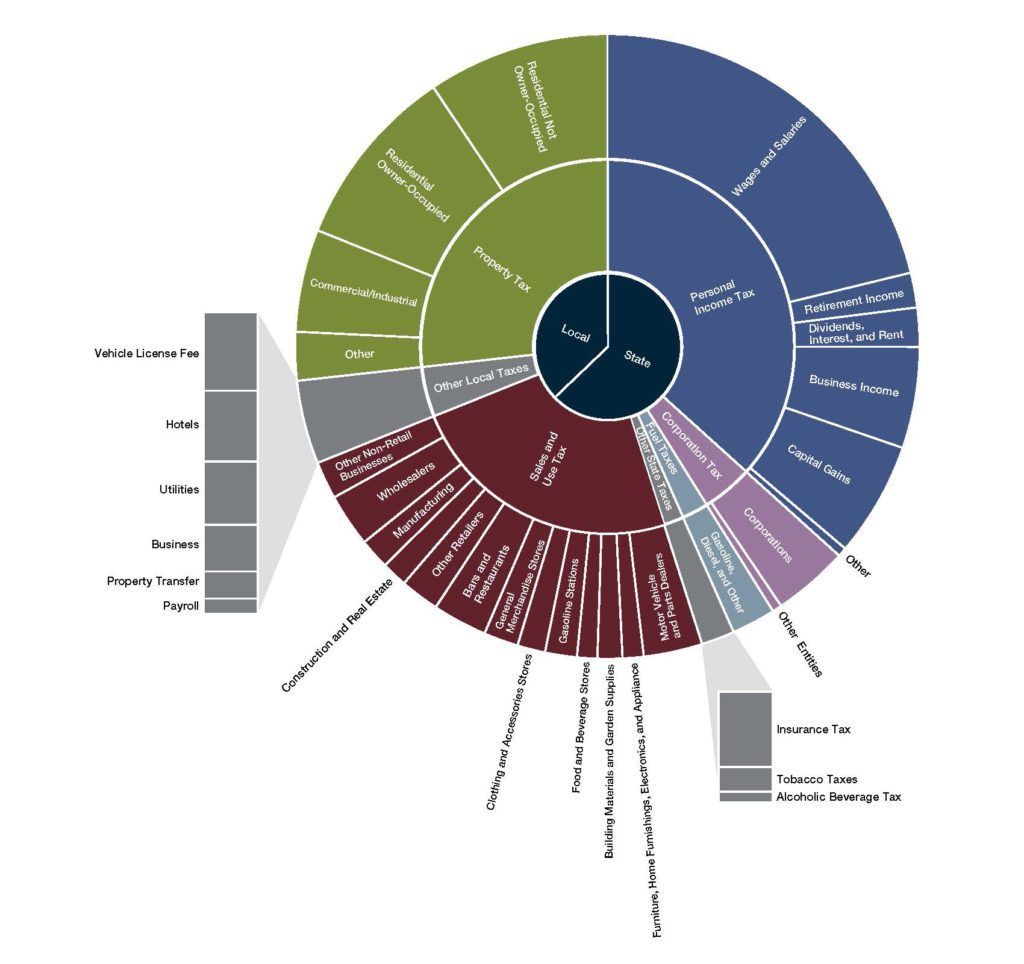

The primary tax revenue sources for the California General Fund include:

- Personal Income Tax (PIT): Levied on the taxable income of residents and nonresidents derived from California sources.

- Sales and Use Tax: Levied on the sale of tangible personal property in California.

- Corporation Tax: Includes both the bank and corporation franchise tax and the corporation income tax.

- Insurance Tax: Levied on the gross premiums of insurance companies.

- Other Sources: Include alcoholic beverage taxes, cigarette and tobacco products taxes, motor vehicle fuel (gasoline) tax, and various other taxes, licenses, fees, and transfers.

LCFF, Proposition 98, and Burbank

Proposition 98 mandates that 40% of the funding from the listed sources educates students in the State. However, LCFF allocations favor districts with more non-English speakers, the poor, and foster children, leading to a perceived disparity in funding between districts like Burbank and Los Angeles Unified School District.

Implications for BUSD

- Diminished State Funding: BUSD receives less supplemental and concentration funding due to fewer English learners, low-income students, and foster youth, leading to financial shortfalls.

- Elevated Local Costs: The higher living standards in Burbank result in escalating operational costs for its schools, not covered by the standard LCFF base grant.

- Local Tax Push: The perceived funding deficit is causing a push to raise local taxes, placing an undue burden on local residents.

Controversies and Community Response

Under former superintendent, Dr. Matt Hill, allegations arose that BUSD increased the enrollment of special needs students and non-English speakers from outside Burbank to boost LCFF funding. Many residents believe that it is time to challenge the LCFF allocations legally and ensure that taxpayer money directly benefits Burbank’s students.

Conclusion

Burbank residents are questioning the fairness of LCFF allocations, feeling they are contributing significantly through state taxes. The idea of paying more locally, without a legal challenge to the LCFF allocations, is seen as unjust. “Burbank needs to take this to the courts, not to our property tax bills,” said Juanita, a local homeowner in Burbank.

40% of Your Taxes (General Fund) Already Go to K-14 Education: See This Chart (Click to Enlarge)